With U.S. stocks hitting all-time highs, and tech stocks being worth more than the entire European stock market combined; you might be wondering if we are in a bubble. It's a serious question especially if you are looking to get in or out of the market in these times.

On a linear scale, the Nasdaq Composite looks like this.

Although the Dow Jones is looking more conservative, skeptics would argue that the market should go down. After all, we are about to enter one of the worst economic crisis due to the Coronarvirus; and unemployment numbers are just terrifying. But the stock market doesn't seem to think so.

Which begs the question: Are we in a bubble?

How are stocks priced anyway?

To argue whether the market is overpriced, we need to figure out how to price stocks. If we know how much a particular company is worth, we should be able to reason about its stock price. Stocks, like many other assets, pay a dividend. A stock, in an efficient market, is worth its future dividends combined.

With this simplification, we can calculate a fair price for the company FANG assuming we know how much it is going to pay in dividends in the future.

FANGfair price = dividend 2020 + dividend 2021 + ... + dividend 2065

Our model calculates the fair price of FANG. If FANG is trading below our model price, we buy. If FANG is trading above our model price, we sell. This is a very straightforward arbitrage; if you are able to accurately predict how much the company will pay in dividends. For the purpose of this article, we'll assume that is true for our imaginary company FANG.

First complication: Inflation

With such a solid framework to price stocks, we can now make a lot of money. Comes the first complication: Inflation. It's easy to be mislead that our strategies are making a profit, when in reality it's inflation that is driving them. Again, to simplify, we are going to assume that we can accurately predict the inflation rate.

With that, let's look at our first scenario: The yearly inflation rate is 10%. Our research office had predicted that the company FANG is going to pay $10 in dividends by the end of the year and then dissolve with no assets left.

According to our model, the company should trade at the sum of its future dividends.

FANGfair price = 2021 dividends = $10

But with inflation, $10 today is worth less than the same $10 in the future. We know that FANG is going to pay $10 in the future regardless of the inflation rate. We need to adjust our price to account for inflation.

FANGfair price (adjusted for inflation) = $9.09

By the end of the year, FANG should be trading at $10; but that future $10 has as much purchasing power as today's $9.09. This adjustment ensures that we do not lose money due to inflation. If we predict high inflation in the future, we should price this particular stock down, not up.

The next scenario has a twist: An imaginary company AAPL produces apples and pays dividends in real apples instead of dollars. Today, an apple cost $1; and with inflation an apple will cost $1.1 by the end of the year. The company AAPL is going to pay 10 apples in dividends by year-end, and also dissolve. What's the fair price for AAPL?

Surprisingly, it's $10. Think about it this way: AAPL is going to pay 10 apples in dividends worth $10 today. That is how much AAPL is worth today. By the end of the year, the apples are worth $11 and AAPL should trade at $11.

This particular stock can protect you against inflation, but only if you buy at reasonable (non-inflated) prices. This means, for this particular stock, inflation has no effects on the price. It doesn't matter how much apples are going to be worth in the future, you are pricing the stock today.

What about deflation?

Deflation is the reverse of inflation. For stocks that generate dollars, deflation should price them up. For stocks that generate apples-like goods, it doesn't matter; as with inflation.

Second Complication: Interest rate

Let's forget about inflation and deflation. In this part, we'll assume that dollars hold stable values, regardless. Our investor has $10 and is looking to put his money to work; he also has no viable use of his money. Unluckily, there is a single company to invest in; FANG. The company will pay $10 in dividend guaranteed by the end of the year and then dissolve.

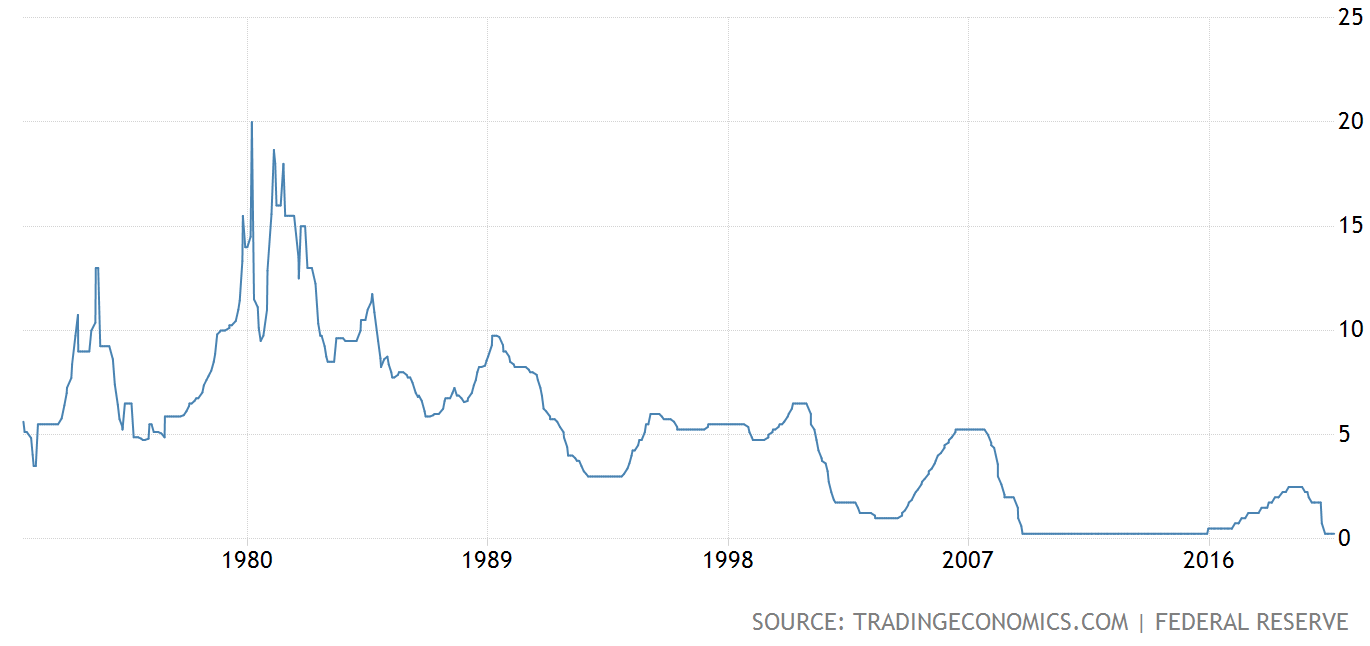

Comes the Fed: The Federal Reserve has announced that it is guaranteeing all of the government issued bonds. This means that these bonds are risk-free since the Fed can print its way out of a loan. These bonds pay 10% yearly and our investor can buy them.

Our investor looks at his trading terminal: He can buy the bonds at $10; and get $11 by the end of the year. Or he can buy FANG and gets $10 by the end of the year. With this new choice (government bond), our investor is unlikely to buy FANG at $10/share. It makes more sense to buy the government bond as it has better yield.

For FANG to make sense, it has to pay (yield) at least as well as the government bond. For that, today, FANG should trade at $9.09 to be of good value for our investor. The market is now at equilibrium: both viable investments now generate an equal yield: 10%.

The trade of the century

With government intervention (which is acting similar to inflation; if you noticed), our investor should be careful about the coupon for these bonds. In the future, these are going to determine how he prices stocks. And how much can this interest rate affect the market? Hold your horses.

Let's analyze this scenario where we have these two companies: FAST and SLOW.

Ticker:

FASTCompany will pay $10 guaranteed by the end of the year and then dissolve. Ticker:SLOWCompany will pay $10 guaranteed after 100 years and then dissolve.

It might seem counter-intuitive but with no inflation and no government bonds, both of these investments are equivalent for an investor with a 100 year investment horizon. This assumes that our investor has no other viable use of his money. On a rational market, under these conditions, both should trade at the same price: $10. After all, if there are no other viable investment, the investor who put his money in FAST is going to hold cash for the next 99 years; ending with a similar yield to SLOW.

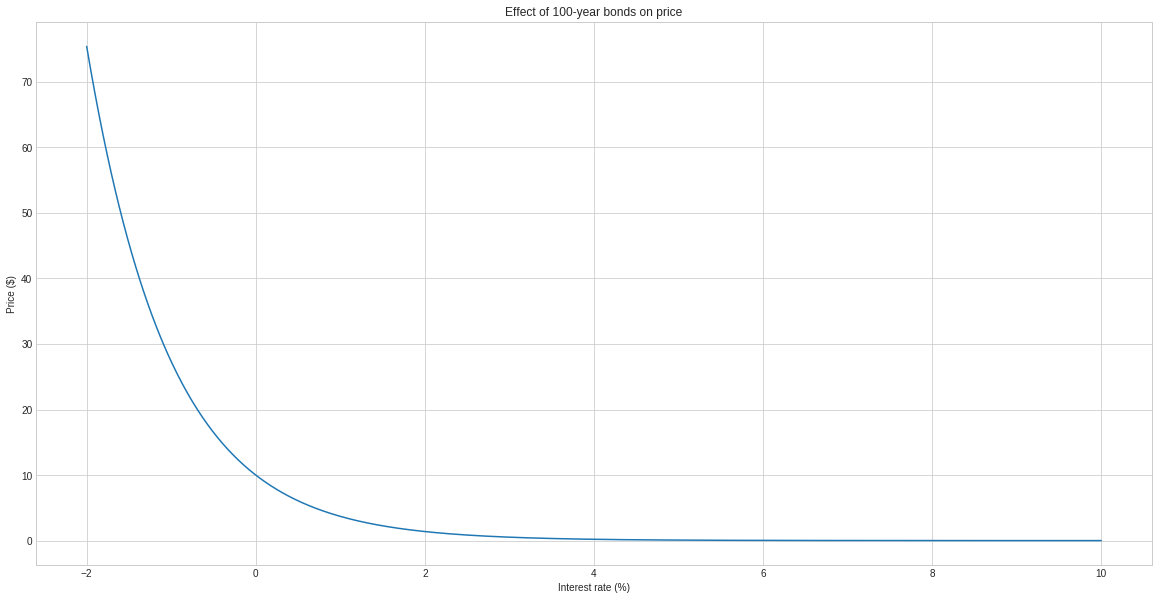

So what happens if the government introduces a 100 year bond with a 10% interest rate payout? Let's do the math.

Ticker:

FASTGovernment yield: %10 Fair price: $9.09 Ticker:SLOWGovernment yield: %1,378,061 Fair price: $0.000725

While the government bond did affect the FAST company slightly, the price for SLOW practically evaporated. Both companies are still the same companies and are going to deliver on their promises. Nothing has changed and yet the prices made it seem like the apocalypse is upon us.

If we start from a situation where government is paying interest and then decides to do it no more; prices are going to go up. This uplift is going to be much more noticeable for stocks with a very far-off payout. A smart or well-connected investor will buy these stocks and then watch his portfolio skyrocket.

Brave New World

The intelligent investor is a recommended reading for people looking to generate yield. It establishes a framework for investing that we summarized above: If bonds have better yield, then buy bonds and sell stocks; and vice-versa. However, low interest rates might stick for a while: Japan has been on this regime for over 20 years and it's unlikely to change in the future.

If you are an intelligent investor, you might think that investors buying or holding assets in these times are crazy. Actually, they could be the most careful. For an investor with a long-time investment horizon, has no viable use of his money and is expecting a regime change to zero or negative interest rate; the best trade is to either buy or hold your assets.

In a negative rate world, it's safe to throw The intelligent investor book. P/E ratios make more sense in a high interest rate world since companies are competing with the risk-free rate. If bonds are generating an income, you want your stocks to generate a comparable dividend. This is the effect that prices far-payoff stocks down.

If Tech companies are perceived to have a very far pay-off, then they become the most affected by a zero or negative interest rate. In that sense, investors are not buying up these stocks; they are just pricing them to the new reality. With Modern Money Theory on the rise, it's possible that negative rates become the norm; especially that MMT response to inflation is to raise taxes not the interest rate.

MMT is the idea that money should be available to anyone who deserves it (ie: If you want to make a transaction, you should have liquidity available). You can think of interest rates as a rent payment to people who own the cash. It's not fair to not be able to conduct business without going through a rentier. On the other hand, today's retirees have benefited from this high-yield to generate massive wealth in the last century by the power of compound interest. This makes them the suitable suitors to buy today's assets which will become inaccessible for most of the workforce once prices adjust.

The upside of MMT and 0% interest rates is that it allows a whole set of businesses to become viable. Businesses with a 1% yield are not viable with a high interest rate as it makes more sense to just buy bonds. People who can generate yield will thrive, since the expected market yield is zero. It's still a question whether this will benefit mainstream; or a bunch of tech companies that have a monopoly of tech and innovation. In this kinda world, tech and innovation are the only possible venues to generate yield, since money is widely available for anything else.

It's possible that MMT becomes the very worst enemy it's trying to protect us from; creating a situation where wealth mobility is practically impossible. After all, the road to hell is paved with good intentions.

So are we in a bubble?

Maybe, but it's also possible that these high prices are here to stay. Since the Euro zone is also on a negative diet; the market reads as follow: Europe is dying (stocks have not risen by negative rates), the Dow Jones will fare better; and the Nasdaq is taking over the world in the medium-long term. If you don't like that reading, maybe it's time to sell.

Subscribe to the Newsletter

Get the latest posts from this blog delivered to your inbox. No spam.